How to File Income Tax Return?

How to Download Annual Government form?

It means quite a bit to how to record ITR on time, to keep away from somewhat late pressure and punishments. Whenever you have recorded your ITR, the annual assessment check structure is produced by the IT division with the goal that citizens can confirm the legitimacy and authenticity of e-documenting. These are relevant provided that you have documented your profits without a computerized signature.

The annual government form confirmation structure can be downloaded in simple tasks.

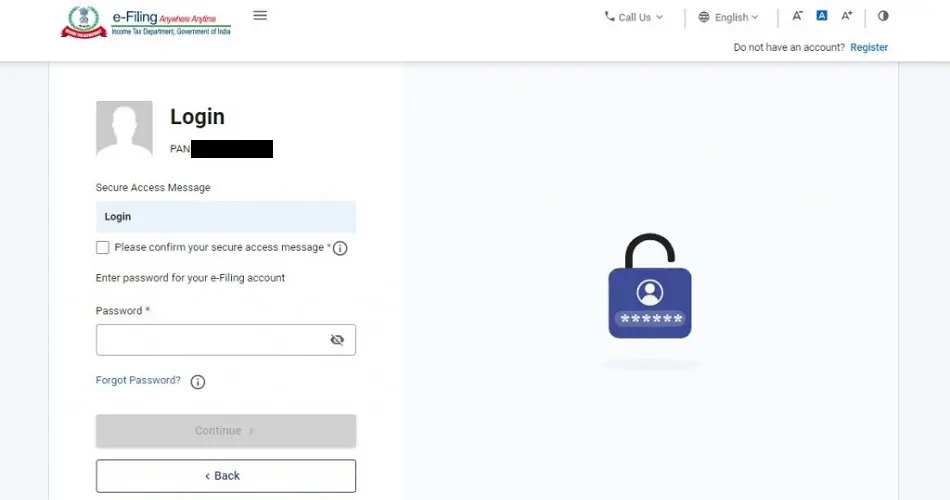

1.) Sign in to the Personal Assessment India site

https://portal.incometaxindiaefiling.gov.in/e-Documenting/UserLogin/LoginHome.html?lang=eng

2.) View e-recorded government forms by tapping on ‘View Returns/Structures’ choice

Select choice Personal expense forms Subtleties of the relative multitude of years for which returns are recorded will be shown

1.) Snap on the affirmation numberto download the ITR-V.

2.) Start the download by choosing ‘ITR-V Affirmation’

3.) To open the downloaded record, enter your secret word to open the archive. The secret key is your Skillet number in lower letters alongside your birthdate.

For instance

Dish – ASIJP2345P

Birthdate – 31/12/1980

Secret word – asijp2345p31121980

You want to send the printed and marked archive to CPC Bangalore in no less than 120 days of the e-filing. There is likewise a choice of E check of Personal assessment form by producing Aadhar OTP, through net banking, through ATM and so on.

Reports expected to fill ITR

It is critical to have every one of the pertinent archives helpful before you start your e-recording process.

Bank and mailing station bank account passbook,

PPF account passbook

Pay slips

Aadhar Card, Container card

Structure 16

– TDS testament gave to you by your manager to give subtleties of the compensation paid to you and TDS deducted on it, if any

Premium testaments from banks and mailing station

Structure 16A

On the off chance that TDS is deducted on installments other than pay rates, for example, premium got from fixed stores, repeating stores and so on over as far as possible according to the ongoing expense regulations

Structure 16B

from the purchaser on the off chance that you have sold a property, showing the TDS deducted on the sum paid to you

Structure 16C

from your occupant, for giving the subtleties of TDS deducted on the lease got by you, if any

Structure 26AS

– your united yearly expense articulation. It has all the data about the duties kept against your Container

a) TDS deducted by your manager

b) TDS deducted by banks

c) TDS deducted by some other associations from installments made to you

d) Advance expenses stored by you

e) Self-appraisal charges paid by you

Charge saving speculation confirmations

Confirmations to guarantee allowances under area 80D to 80U (health care coverage charge for self and family, interest on schooling advance)

Home credit articulation from bank

How to check ITR status on the web?

Whenever you have recorded your annual assessment forms and confirmed it, the situation with your assessment form is ‘Checked‘. After the handling is finished, the status becomes ‘ITR Handled‘.

Assuming you wish to realize which stage your assessment form is in the wake of recording it and need to check your ITR status on the web, this is the way you can do it in simple tasks.

Choice One – Without login certifications

You can tap on the ITR status tab on the super left of the e-documenting site.

You are then coordinated to another page where you need to fill in your Container number, ITR affirmation number and the manual human test code. Whenever this is finished, the situation with your recording will be shown on the screen.

Choice Two – With login accreditations

Login to the e-recording site.

Click on the choice ‘View Returns/Structures’

From the dropdown menu, select personal expense forms and appraisal year

Whenever this is finished, the situation with your documenting (whether just checked or handled) will be shown on the screen.

Keeping the Personal Expense Division informed about your pay and taxability will keep you on the right half of the law and forestall any blocks in your monetary ability. Since it is now so obvious whether you mandatorily need to document your ITR, you really want to guarantee that you complete the interaction on schedule consistently.

Watch this Also :

Visit : GServices

Subscribe – RapchikAdda :